GuideTypes

What is the difference between bearer bonds and registered bonds?

Most Eurobonds are said to be “bearer bonds” meaning that they do not require the registration of specific ownership details such as the name of the holder. The holder of a bearer bond can easily sell that bond without the need to change administrative ownership details. Nevertheless, paying agents will have basic ownership details in order to transfer principal and coupon payments to the correct owner at relevant times.

In contrast, registered bonds are connected to the holder and more details are stored. In case of a sale, the full ownership details will need to be adjusted to the new owner in a general register.

Most Eurobonds are bearer bonds.

What are bullet bonds?

Most Eurobonds redeem at maturity when the issuer pays the last coupon and returns the principal to the investor. A simple structure like this is called a “bullet structure”.

Sometimes bullet bonds are referred to as “plain vanilla” bonds. Other popular structures can have embedded options such as call/put options, a sinking fund or a convertible structure.

A bullet bond does not have an embedded option and therefore the (payment) structure of the bond is fixed until it’s maturity date.

One way an issuer can change the structure of the bond (the amount outstanding for example) is through a corporate action. The issuer, however, is bound by the restrictions set out in the prospectus of the bond. An issuer can buy back (part of) their Eurobond in the secondary market through a “tender”. Corporate actions, prospectuses and tenders will be discussed in a different sections of this guide.

What are callable bonds?

Some bonds are issued with a call option embedded in the structure. Such an option allows the issuer to call back (i.e. redeem early) the entire Eurobond at a fixed date and fixed price prior to its maturity date.

A call option is advantageous to the issuer and is usually exercised when the issuer believes it can refinance itself at a lower borrowing rate on the call date or thereafter. In other words, if borrowing rates have dropped compared to the bond’s existing coupon rate it may be in the interest of the issuer to call back the Eurobond and re-issue a new Eurobond locking-in a lower borrowing rate. For an investor this is a disadvantage as it may lead to unwanted reinvestment risk prior to the maturity date of the bond. Issuers usually pay a premium call price in order to partially compensate the investor.

There are variations amongst callable bonds in terms of the call price and call date schedule. Callable bonds with a "soft call schedule" give the issuer more flexibility with respect to the call date and call price. For example, multiple call dates and call prices could be part of a soft call schedule. A typical soft call schedule allows an issuer to not just to call the bond on the exact call date, but also on any date thereafter. Call dates, call prices and call date schedules are disclosed in the bond's prospectus and publicly known to investors.

For illustration purposes, please see the below soft call schedule of a Eurobond. It clearly shows that the issuer can call back the bond at three specific dates and at three different fixed prices.

| Call Date | Call Price |

|---|---|

| April 1st 2020 | 104.625 |

| April 1st 2021 | 102.313 |

| April 1st 2022 | 100 |

What are sinkable bonds?

Sinkable bonds are bonds that pay back the investor a portion of the total principal before their maturity date. It is said that the bond “sinks”.

Usually the issuer provides a clear sinking schedule, which showcases the exact dates and the principal prepayment amount. A factor is applied to determine the prepayment of principal amount. For example, an issuer repaying the principal over 3 equal instalments in the last 3 years of the life of the bond is said to apply a 0.33 factor. In other words, for a $1.5bn sinkable Eurobond maturing in 2030, $500MM will be repaid in 2028, $500MM in 2029 and the final $500MM on the maturity date in 2030.

It is important to note, that the factor reduces the amount outstanding of a Eurobond. This means that subsequent coupon payments will be calculated using a lower total nominal amount outstanding. In other words, investors will receive a lower coupon amount whenever a Eurobond starts "sinking".

This is best explained by using an example. Say, a Eurobond with a $1.5bn amount outstanding and a 5% fixed coupon rate pays back the principal over 3 equal instalments in the last 3 years of its life. The period before the sinking schedule kicks in, means the issuer pays a $75MM coupon per annum (5% of $1.5bn). On the first principal prepayment date, the amount outstanding is reduced by $500MM, however the coupon payment is still based on the initial outstanding amount of $1.5bn. However, the next coupon payment will be based on the reduced amount outstanding, $1bn, and will therefore be $50MM (5% of $1bn). The following year, the final $500MM is repaid and the issuer will pay a final coupon amount of $25MM (5% of $500MM).

As the above example illustrates, a sinking structures imposes reinvestment risk to an investor as part of the principal is repaid before the maturity of the date. On the other hand, it reduces credit (default) risk as prepayment enhances comfort levels amongst investors.

A sinking fund is usually held in escrow and will be tapped to repay the principal whenever the sinking date schedule kicks in.

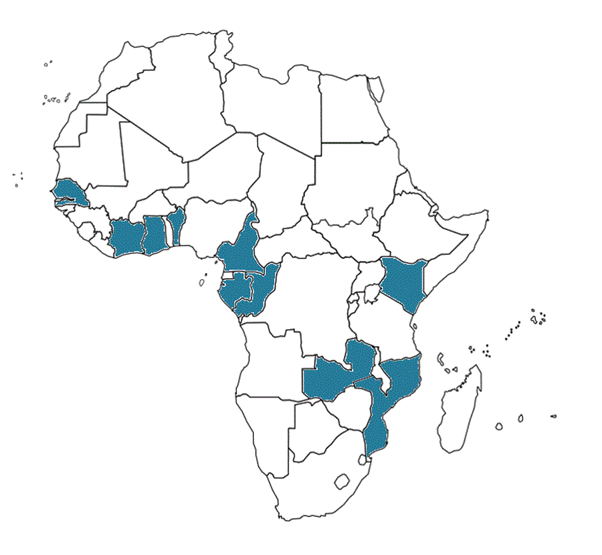

Sinkable bonds are rarely issued by non-sovereign issuers. Although, Nigeria has no outstanding sinkable Eurobonds at present, it is a popular structure for other sub-Sahara African sovereign issuers. An illustration of sub-Saharan Africa countries that have issued sinkable bonds (and how many) is presented below:

Countries: Benin (2), Cameroon (1), Republic of Congo (1), Gabon (2), Ghana (11), Côte d’Ivoire (7), Kenya (2), Mozambique (1), Senegal (3), Zambia (1).

What is a Diaspora Bond?

A (sovereign) issuer of a Diaspora Bond aims to target citizens who are living abroad as the investor base for a Eurobond issuance.

A Diaspora Bond is sometimes believed to be as much as an emotional investment as a commercial one. This is because the issuer taps into the “patriotic” or "sense of belonging" feeling towards the homeland. Currently Nigeria has one outstanding Diaspora Eurobond with $300 million outstanding and a maturity in 2022. Other African countries, like Ghana, have hinted of Diaspora bond issuance as part of their budget plans in the past.

The June 2022 Nigerian government bond was issued to appeal to Nigerians living abroad, i.e. the Nigerian diaspora. One of the key features of Nigeria’s Diaspora Bond is that the low minimum nominal amount that can be invested in the bond is $2,000. This is significantly below the $200,000 nominal set for other Nigerian (or African) Eurobonds. Officially the Diaspora bond cannot be defined as a Eurobond though, however for the sake of simplicity we have done so in this guide.

The low minimum nominal threshold of a Diaspora Bond relates to so-called "Fractional Bonds". Please visit the Fractional Bonds section to find out more.