Daily Nigerian, Ghanaian

and Angolan Eurobond Pricing

Find out more about Nigerian, Ghanaian and Angolan Eurobonds through HowNoww.

Live pricing to stay updated on price performance, coupon calendars & schedules to observe when coupons are due, a cash calculator to determine cash proceeds per bond and a helpful guide to help you understand Eurobonds even better.

Our mission

Opening up Africa’s Eurobond market for everybody

We want to tell everybody about African Eurobonds by getting more people involved with Africa’s capital market and make Eurobonds the simplest asset class.

Free

- We believe that the best way to open up Africa’s Eurobond market is by keeping things simple. All our Eurobond data is provided free of charge.

Inclusive

- We offer various tools to allow you to check Eurobond data beyond just pricing information.

Up to date

- All our Eurobond prices are updated up to 7 times a day to ensure reliability.

Accurate

- Our algorithm-enhanced Eurobond pricing uses various data variables and is periodically cross-checked to provide you with high levels of accuracy.

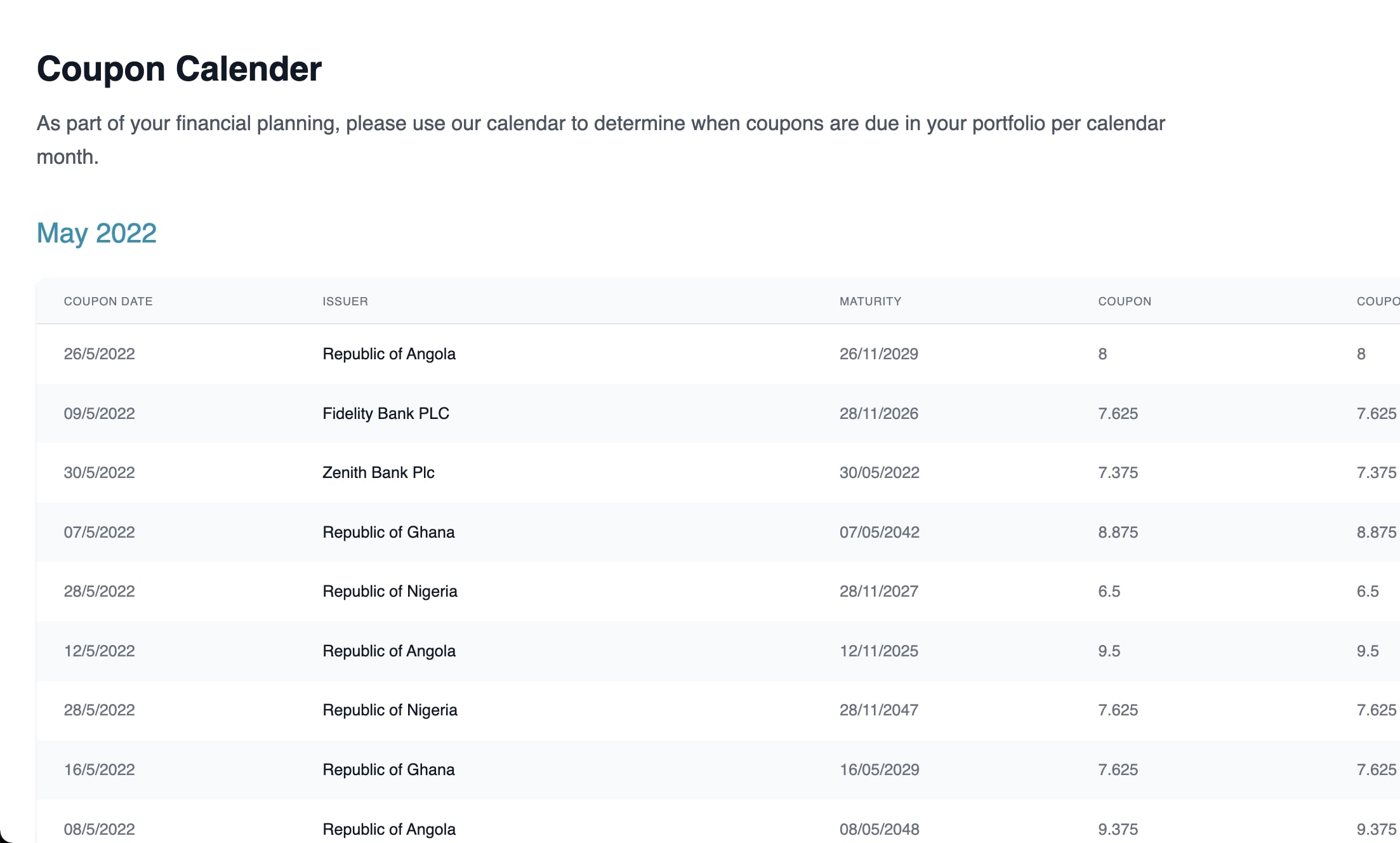

Coupon Calendar

To help you in planning your finances, our coupon calendar allows you to check when our Eurobonds pay a coupon in each calendar month.

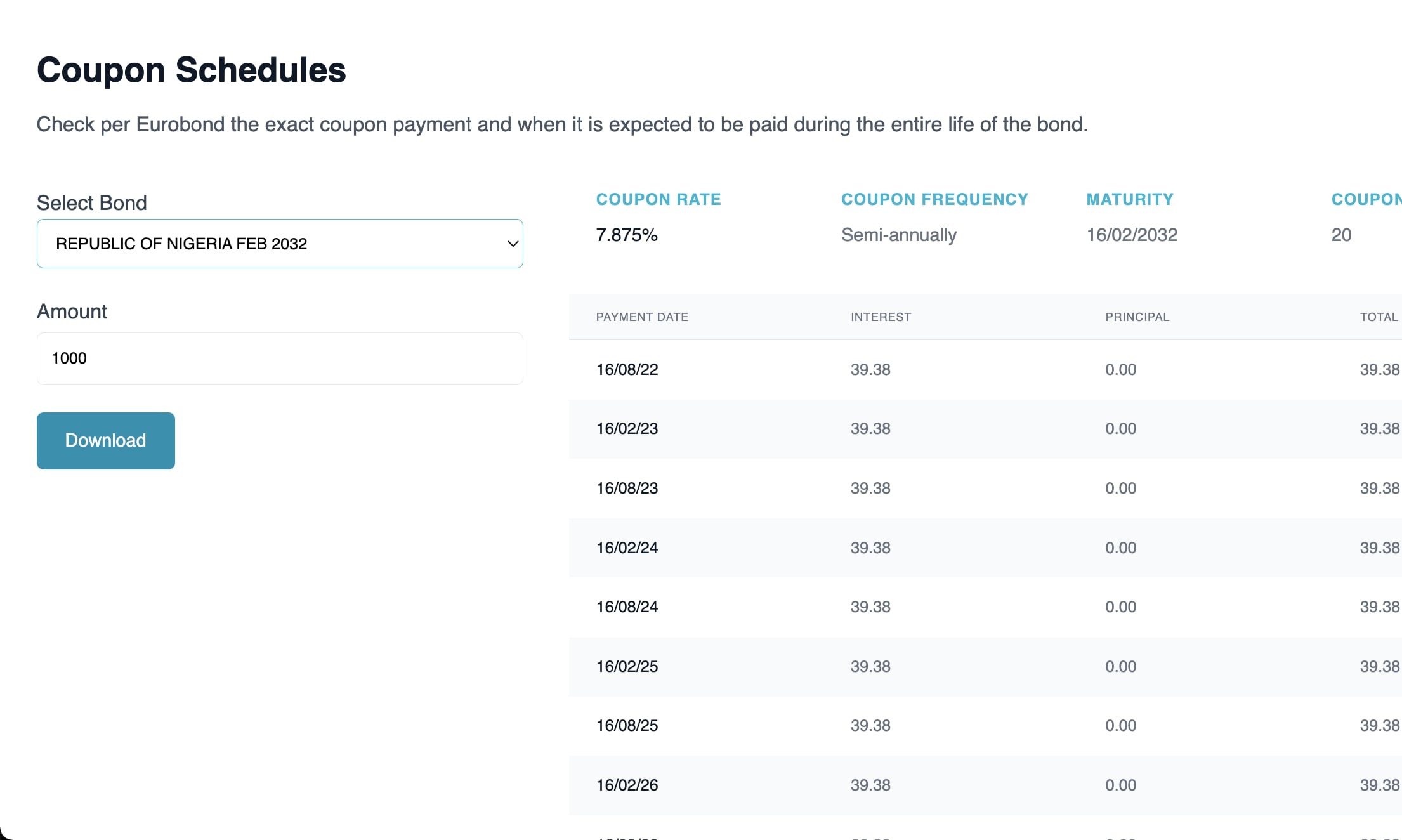

Coupon Schedules

Our coupon schedule section enables you to check when coupons are due for each Eurobond and observe it’s entire payment schedule.

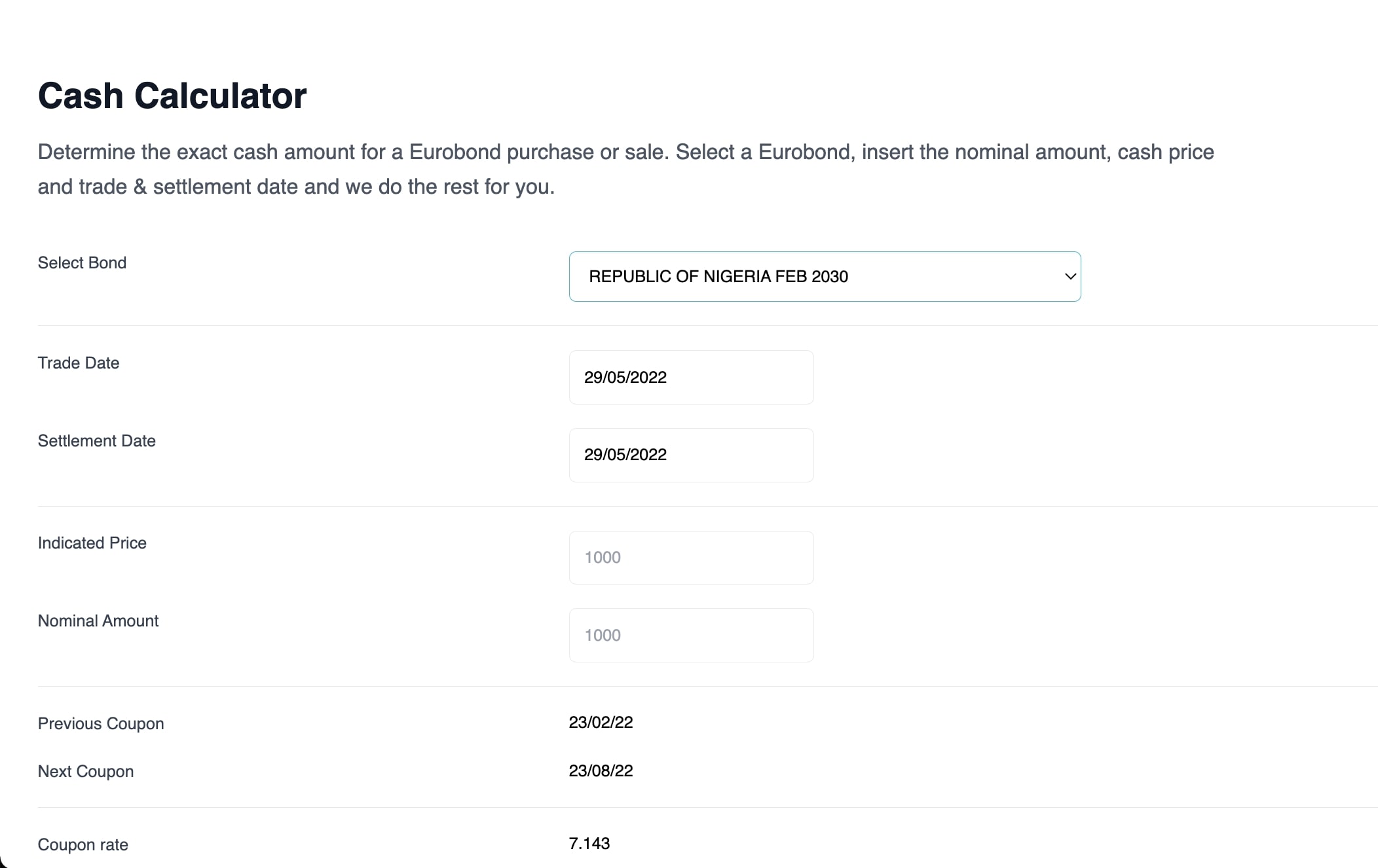

Cash Calculator

A handy cash calculator will help you determine the exact cash amount for a potential Eurobond purchase or sale.

Eurobond Guide

Our guide will tackle all of the financial jargon and other ins and outs you may need to be aware of when investing in Eurobonds

FEATURING EUROBOND DATA FROM NIGERIA, GHANA & ANGOLA