GuideIssuance

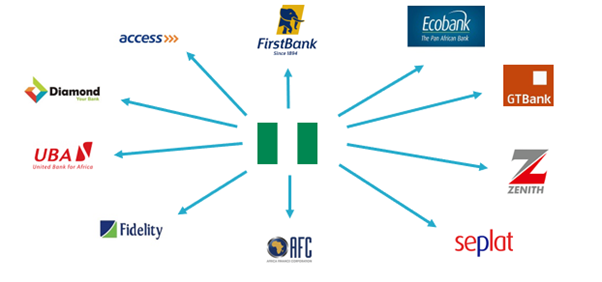

Who has issued Eurobonds in Nigeria?

Whenever there is a funding need, the Republic of Nigeria issues sovereign Eurobonds. Besides the sovereign, Nigerian banks, supranational agencies and corporate companies have been major Eurobond issuers.

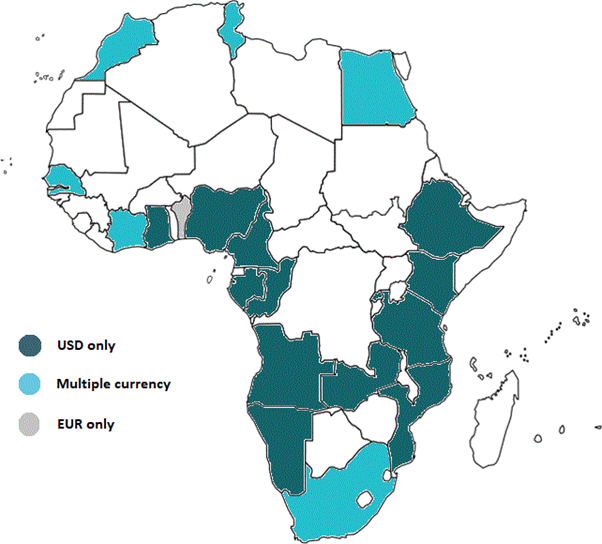

Who has issued Eurobonds in Africa?

Who exactly issues sovereign Eurobonds in Nigeria?

The finances of the Federal Republic of Nigeria are managed by it’s Ministry of Finance who subsequently has mandated the Debt Management Office (“DMO”) with the issuance and management of Eurobonds. The same structure is usually adopted by other countries too.

Why are Eurobonds issued?

Eurobonds are largely used as a funding tool for issuers. Instead of, or alternatively to, borrowing from the banking system, issuers are able to borrow directly from capital market participants through Eurobond issuance.

There a several advantages of Eurobond issuance:

- Borrowing from the public can potentially reduce borrowing costs.

- Eurobond issuance can allow for more flexibility in terms of the maximum amount borrowed, the tenor, the use of proceeds or the repayment structure.

- Eurobond issuance could raise the public profile of the issuer. Eurobond issuance provides investors with an opportunity to assess the issuer’s investor relations and corporate governance standards in particular, which may increase brand awareness.

- Eurobonds are largely standardised products that are issued on a routine basis. For this reason capital markets can be easily and quickly tapped in the future.

- Euorbond issuers may have exhausted borrowing means through conventional credit facilities.

Access to capital markets is typically reserved for larger companies and therefore providing a key bottleneck for smaller issuers.

What are the proceeds of Eurobonds used for?

Eurobonds do not tend to disclose what the borrowed funds will be used for. Bank loans generally require disclosure of use of the proceeds in order for the bank to determine credit and repayment risk. Because issuers in Eurobond markets borrow funds from a substantial number of different investors (sometimes thousands), this requirement is less clear.

The main uses of proceeds are:

- Refinance of existing Eurobonds

- General corporate use

- Capital expenditures

For especially sovereign issuers, refinancing is a the main use of proceeds. This is where the proceeds of a newly issued Eurobond are used to repay a previously issued Eurobond.

Is there an issuance calendar for Eurobonds?

There is no calendar telling investors when Eurobonds are issued and by who. Eurobonds are issued at the issuer’s discretion. This differs from domestic debt issuance which follows a predefined issuance calendar.

With the help of investment banks (“bookrunners”), an issuer usually visits investors prior to the issuance to get a feel for investor appetite and pricing (“roadshow”). The time from announcement of a roadshow to the actual issuance of Eurobonds usually takes 1-2 weeks. Issue size, the actual coupon rate and issue yield are only confirmed and publicised once the Eurobond is formally issued. Investors are usually only provided limited guidance prior to the issue date.